From the outset, explaining coin grading can be very prudent. If you’ve ever contemplated acquiring or selling a vintage coin or two (remember, a vintage coin is any coin minted before 1964), this knowledge will be beneficial!

To put it in a nutshell, coin grading allows collectors, investors, and sellers alike to assess the quality of the coin according to established standards. These standards will help facilitate a level playing field in determining a coin’s current market value.

However, the dirty little secret about coin grading is that it’s not an undertaking that can be achieved overnight; it requires extensive knowledge and experience. As you explore this article, we hope to provide some background on coin grading to help you analyze information so you are not marginalized when buying or selling any vintage circulated coin.

History of Coin Grading

For many centuries after the Romans had departed Rome, coinage was not well-regarded for its aesthetic qualities.

Even centuries after the Fall of Rome, currency minted from precious metals was seen as a mere means to an end – as indicated by its common denomination of 1 penny (denarii). The interpretation of a coin’s purpose remained consistent even following the advent of paper money in the Middle Ages.

By the 1300s, however, some individuals began appreciating coins’ looks and aesthetics, so much so that they started assigning values to coins based solely on these characteristics. By 1400, this practice had become established throughout Europe.

Then came a period when numismatics (the study of coins, paper currency, and medals) achieved prominence in European society. During this era – which panned over several centuries–scholars focused on studying coins, crafting them into beautiful works of art, and organizing their collections into museum archives. We have all heard the term – coin collecting, the hobby of Kings.

Coin Grading: the Sheldon Scale

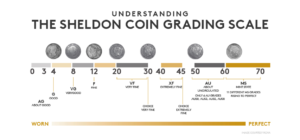

William Herbert Sheldon created the original scale in 1949 as a 70-point system to assess a coin’s quality and value.

Dr. Sheldon was a well-known psychologist and a pioneer in the field of somatotype, which he described as the science of categorizing humans’ psyches to their body type. As an avid collector of US large cents, he thought he could also classify his coins. In 1949 he wrote his first book on numismatics called “Early American Cents,” in which he described a way to value “large cents” by a multiplier based on their condition. An example would be a coin in perfect condition that would take its base minted face value and multiply it by 70 for its current retail value. In describing this scale, Dr. Sheldon identified 18 quality conditions, and the scale was identified from 0 to 70. As time passed and the importance and popularity of numismatics continued to grow, the Sheldon scale was being morphed and adapted to the whole field of numismatics. In 1977, a book was compiled for the American Numismatic Association by three innovators, Abe Kosoff, Q. David Bowers, and Kenneth Bressett, called Official American Numismatics Association Grading Standards for United States Coins. Today the Sheldon Scale has 29 grading conditions, with coin values determined by the open market.

Open Market

The definition of the open market in coin collecting means that the value of any given coin in a specific condition (Sheldon Grade) is determined by what somebody has recently paid. Before Dr. Sheldon wrote his first book in 1949, coin dealers and enthusiasts tried to record these values and conditions. In 1942, Whitman Publishing and Richard Yeoman introduced the Handbook of US Coins (the Blue Book), which provided background information on all US coins and established a baseline for coin dealers and enthusiasts, which is still being published yearly today. In 1946, Richard Yeoman Published his companion book, The Guide to US Coins (referred to as the Red Book), which is sold yearly to the growing general world of coin collecting. This Red book has sold over 24 million copies. It should be noted that the common denominator between the “Official ANA Grading Standards for United States Coins” and “The Guide to US Coins” is Kenneth Bressett, who I believe was the single most significant contributor to bridging Sheldon Grades to the world of the Open Market prices. As the coin-collecting market grew in terms of the public and coin dealers, other publications began to appear as printing and data acquisition technologies improved, with the most notable coming from the Coin Dealer Network, CDN, which was started by Orvil Payne in 1963. Today this subscription-based publication is called “The Greysheet”, published quarterly, and continues the tradition of open market prices typically paid by coin dealers for any given coin based on the (Sheldon Grade).

The Dirty Little Secret

In coin collecting, it is not just the coin series, date, and mint mark that determines the value of your coin; it is also the (Sheldon Grade) condition defined by the ANA, outlined in the “Official American Numismatics Association Grading Standards for United States Coins.” (Discussed earlier). This book, with 29 possible Sheldon grades is defined in terms of wear, contact marks, scratches, spots, toning, luster, and strike quality related to each coin series. You may be surprised that a Sheldon grade can double, triple, or even 10X the value of your coin based on that single grade determination certified by a recognized professional. To further exacerbate the situation, two independent 3rd party professional coin grading companies provide over 95% of the Sheldon grades on coins collected today; the characteristics of these companies are that they use a subjective process that is costly, time-consuming, and cumbersome to deal with. To be sure, professionally and independently graded coins are necessary for any buyer or seller of vintage coins to maximize the true value of the coin.

Coin Grading Landscape

Three things will stick out as one looks at the options for coin grading. First, the market is dominated by two companies, PCGS, Professional Coin Grading Service, which started in 1986, and NGC, Numismatic Guaranty Company, which began in 1987. These organizations have flourished over the past 35 years as coins continue to age. These companies provide subjective human coin grading that offers their members consensus-experienced opinions to grade their raw coins, which are then encapsulated for tracking and protection purposes.

In all cases, these 3rd party professional coin grading companies require the raw coins to be shipped to the companies and returned to their customers in a process that can take weeks to complete and, of course, at a substantial fee estimated to be greater than $20 per coin which does not include the shipping.

Lack of Technology

The second thing that sticks out in the market is that no equipment or software is identified as essential to the general Sheldon coin grading equation besides a seven or 10X magnification loop, 100W incandescent bulb, and a series of photographic books to use in your own subjective coin grading analysis. This lack of general and experienced coin grading knowledge has created a wild west environment where the knowledgeable can pray on the uneducated, especially for coins that don’t justify the cost of the 3rd party professional grader. This wild west mentality is further promoted by social media platforms like eBay and Facebook, which sell valuable coins in the thousands per day with no real qualification other than a questionable 2D photo. We can illustrate this point by analyzing a couple of coin series from some of the data on eBay during a 7-day auction period. Take, for example, the Lincoln Wheat penny series; on April 17, 2023, eBay listed over 130,000 of these pennies, with only 14% of these coins professionally and independently graded at an average sale price of $22.71. The other coin we looked at on the same day was the Morgan Silver Dollar, with over 115,000 coins listed and 58% professionally and independently graded, with an average sale price of $147.00. In this simple analysis, we can deduce several thoughts; first, many valuable vintage coins remained uncertified. Second, people seem to believe in professional independent coin grading if the coin value exceeds the cost of the service. Third, almost all these coins bought on these social platforms are either over or undervalued based on a simple, unreliable 2D photo instead of a solid independent Sheldon grade. And lastly, the real value in vintage coins sold on eBay seems to be in Lincoln Wheat, with the average Morgan Silver Dollar selling at 147X its face value compared to the whopping 2271X multiplier attached to Lincoln Wheat.

Professional Coin Grading Adds Real Value

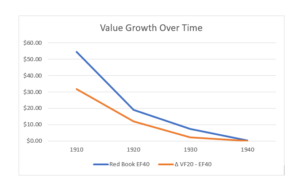

The third thing that sticks out is that the value and volume of retired coins in any condition continue to increase over time. For the sake of this section, I would like to focus on the coinage, with my attention on the Lincoln Wheat penny. History seems to tell us that coins, not including minting defects (which have their own value dynamics), become valuable to a coin collector after 100 years in circulation. Life expectancy for any coin is estimated to be around 30 years, with circulation control as a passive function by population hoarding, collecting, saving, neglect, and loss. In another simple analysis of Wheat pennies from 1910 to 1920 graded at EF40 using the (Sheldon Grade) condition criteria, the average 2023 red book price for these coins is about $54.63/penny. Upon further analysis, the Lincoln Wheat of the 1920s has an average red book price of $18.96/penny for the same EF40 grade, with the 30s at $7.32/penny and the 40’ coming in around $0.37/penny. In the graph below, you can also see I have charted the average prices of Lincoln Wheat for the VF20 for the same time periods. In general, I think the data shows us that at a certain point, after each decade passes, the value of a coin tends to go up exceptionally. The same dynamic is also true as you look at the delta difference between a VF20 and an EF40 of the same penny; the 1910s show an average delta of $31.88/penny, the 20s at $11.88/penny, the 30s at $2.14/penny with the’40s at $0.15/penny. As with time, the delta also becomes more significant between grades.

The Future of Coin Grading

The graph above shows some exciting data and the value of professionally and independently graded coins rather than an unreliable 2D photo and somebodies educated word, considering that the Federal government circulated over 16.5 billion pennies during these 40 years as the population grew by only 59 million. A simple analysis will show that the USA produced about 21 pennies per person during the 20s and has effectively increased that production every decade, which includes the decade of 2010, which produced about 229 pennies per person versus its current population. In this simple analysis, I’m not trying to make any predictions or assumptions but rather to point out that more coins will enter the coin-grading arena over time, and professional and independent coin grading will and should continue to grow. It just seems that the whole coin-collecting market would benefit if we had a more efficient way to grade coins professionally and independently, other than the outdated, time-consuming, and subjective process that is currently used.

Richard L Colonna

Quantitative Coin Grading, LLC

4/18/23